In the fast-evolving world of eCommerce, having the right payment gateway is essential for any business. With the rise of digital payments in India, offering secure and seamless transactions can significantly improve customer satisfaction and boost conversion rates. Choosing the correct payment gateways for ecommerce websites in India is crucial, whether you’re a small startup or a large enterprise. The exemplary gateway can streamline the checkout process, offer multiple payment options, and safeguard transactions against fraud.

India’s payment gateway landscape offers a wide range of options, each with its unique features and pricing. Popular choices like Razorpay, PayU, and Paytm are ideal for small to medium businesses, while larger enterprises may prefer HDFC Payment Gateway or ICICI Payseal. Mobile-focused solutions like Juspay and MobiKwik also cater to the growing number of smartphone users. Selecting the best gateway can enhance customer experience, ensure secure payments, and drive business growth.

Top Payment Gateways for eCommerce

When it comes to payment gateways in India, there are a few popular options specifically tailored to the Indian market. These gateways are designed to handle local payment methods like UPI, RuPay, Netbanking, and domestic credit/debit cards. Let’s add some of the best Indian payment gateways to our list.

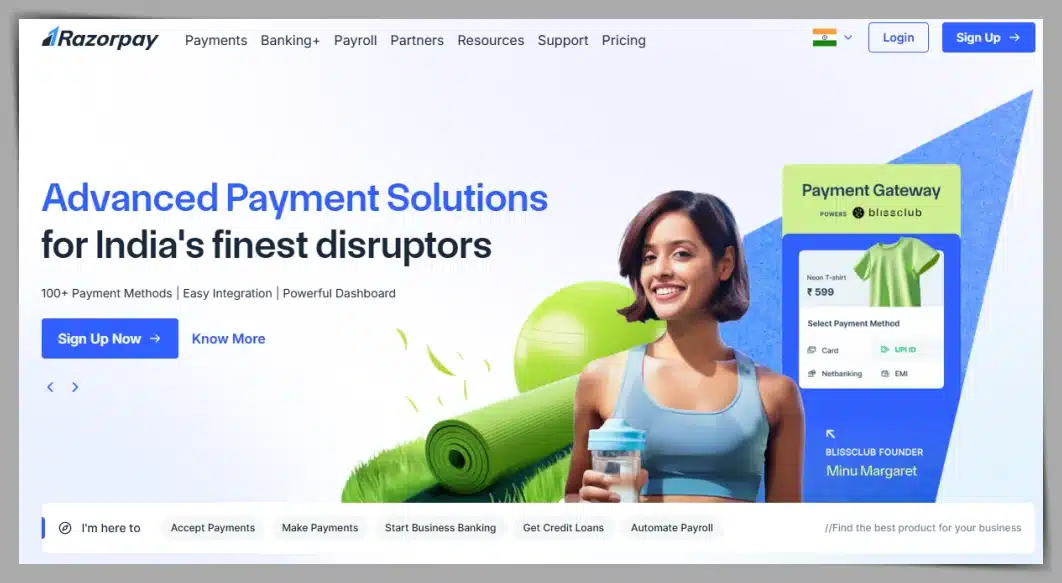

1. Razorpay: The Versatile Indian Payment Gateway

Razorpay is one of the most popular payment gateways for e-commerce websites in India. It is known for its simplicity and versatility. It supports a wide range of payment options, including UPI, Netbanking, and cards.

Features and Benefits

- All-in-One Payment Solution: Accepts credit cards, debit cards, UPI, net banking, and wallets like Paytm and PhonePe.

- Recurring Payments: Ideal for subscription-based businesses.

- Easy Integration: Works seamlessly with major eCommerce platforms like Shopify, WooCommerce, and Magento.

- Multi-Currency Support: Though primarily used in India, Razorpay supports international payments.

Pricing and Fees

- Domestic Transactions: 2% per transaction for standard cards and UPI payments.

- International Cards: 3% per transaction.

Pros

- Versatile payment options, including UPI.

- Quick and easy setup for Indian merchants.

Cons

- Slightly higher fees for international payments.

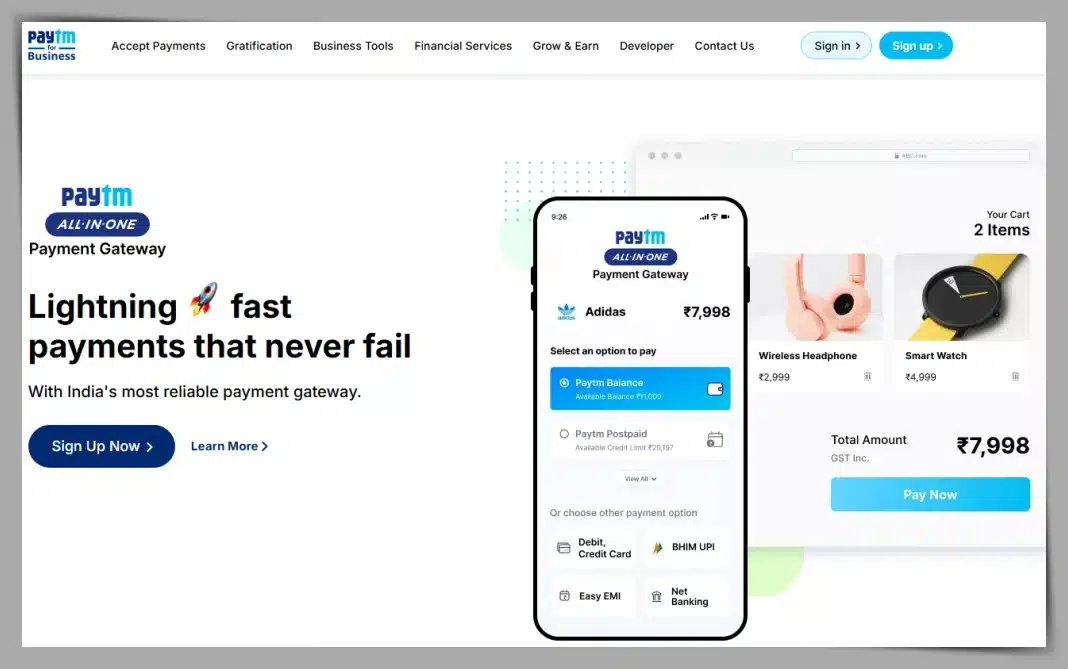

2. Paytm Payment Gateway: Built for Indian Users

Paytm is a household name in India that is widely recognized for its mobile wallet. The Paytm Payment Gateway is an extension of its ecosystem, offering businesses a reliable way to accept payments.

Features and Benefits

- Comprehensive Payment Methods: Supports Paytm Wallet, UPI, credit cards, debit cards, and Netbanking.

- Instant Settlements: Businesses can get funds transferred to their bank accounts quickly.

- Subscription Billing: Ideal for recurring payments and memberships.

- Merchant Dashboard: Real-time transaction tracking and detailed reporting.

Pricing and Fees

- Transaction Fee: 1.75% for UPI payments and 2.75% for credit and debit cards.

- No Setup Fees: No charges to set up an account.

Pros

- Millions of Indian users trust them.

- Instant settlement and easy integration.

Cons

- Slightly higher transaction fees for cards.

3. CCAvenue: The Long-Time Player in India

CCAvenue is one of India’s oldest and most established payment gateways for e-commerce websites. Thousands of businesses trust it, and it supports a wide range of payment options and has unique features.

Features and Benefits

- Multiple Payment Options: Supports 200+ payment options, including UPI, credit cards, debit cards, net banking, and wallets.

- Multi-Currency Support: Great for businesses targeting global customers.

- Fraud Detection: This includes a risk management system (RMS) for fraud protection.

- Subscription Billing: Supports recurring payments.

Pricing and Fees

- Domestic Cards, net banking, and wallets: 2%—3% per transaction, depending on the payment mode.

- International Payments: 3.5% for international cards.

Pros

- Established and highly reliable.

- Extensive payment options.

Cons

- It has a slightly complicated interface compared to newer gateways.

4. Instamojo: Best for Small and Medium Businesses

Instamojo is explicitly designed for small and medium businesses in India. It offers an easy-to-use payment gateway for e-commerce sites in India, with a focus on micro-entrepreneurs. It is the best alternative to Shopify for building an e-commerce website and offering comfortable payment gateway services.

Features and Benefits

- Payment Links: Allows you to create and share payment links without needing a website.

- Multiple Payment Options: Accepts payments via UPI, wallets, net banking, and cards.

- Merchant Dashboard: Easy tracking of transactions and analytics.

- Free Store Setup: Instamojo also lets you set up a free online store to sell products.

Pricing and Fees

- Transaction Fee: 2% + ₹3 per transaction for most payment methods.

- International Payments: An additional 2% is charged.

Pros

- Perfect for small businesses and freelancers.

- There is no need for a website to accept payments.

Cons

- Limited features for larger businesses.

5. Cashfree: Simplified Bulk Payments

Cashfree is a leading payment gateway in India. It is known for its easy bulk payment solutions and seamless integration with popular platforms. It’s perfect for businesses looking to process payouts and payments.

Features and Benefits

- Instant Refunds: Provides an easy way to issue refunds directly to customers.

- WComprehensivePayment Methods: Accepts payments via cards, UPI, net banking, and wallets.

- Bulk Payments: This allows you to process bulk payouts, which is ideal for businesses needing to pay multiple suppliers, employees, or partners.

- Recurring Payments: Great for subscriptions and memberships.

Pricing and Fees

- Transaction Fee: 1.75% + ₹2 for UPI payments, 2% + ₹3 for cards and Netbanking.

- No Setup Fees: Free account setup.

Pros

- Easy bulk payment solutions.

- Instant refunds and settlements.

Cons

- They have limited customization options.

6. PayU: Widely Used in India

PayU is another popular payment gateway in India, trusted by thousands of online businesses. It offers a secure and reliable solution for both large and small enterprises.

Features and Benefits

- WBroadPayment Support: Accept payments via UPI, cards, net banking, and wallets.

- Multi-Currency Support: Supports payments in 45+ currencies.

- Fraud Prevention: Includes PCI-DSS compliance and secure transaction protocols.

- Easy Checkout: Quick and easy checkout process for customers.

Pricing and Fees

- Transaction Fee: 2% for UPI and 2.5% for credit and debit cards.

- No Setup Fees: Easy to sign up and start using.

Pros

- They are trusted by large enterprises and startups alike.

- Excellent fraud protection and secure transactions.

Cons

- Higher fees for international transactions.

7. Juspay: Lightweight Payment Gateway

Juspay is a fast-growing payment gateway known for its lightweight integration and smooth user experience. It’s beneficial for mobile-first businesses.

Features and Benefits

- UPI Integration: Fully integrated with UPI for seamless mobile payments.

- Customizable Checkout: Offers a simple, fast checkout experience with minimal redirection.

- Tokenization: Enables secure transactions with card tokenization and PCI DSS compliance.

- One-Click Payments: Allows users to pay with a single click, enhancing the conversion rate.

Pricing and Fees

- Pricing is customized based on business volume. Contact Juspay for detailed pricing.

Pros

- Fast and simple integration.

- Excellent for mobile eCommerce platforms.

Cons

- It’s not as feature-rich as some more prominent gateways.

8. EBS (E-Billing Solutions): Trusted by Indian SMEs

EBS, a part of the Ingenico Group, is one of the oldest payment gateways for ecommerce websites in India. It’s known for its secure transactions and flexibility, making it a reliable option for eCommerce businesses.

Features and Benefits

- Multi-Currency Support: Ideal for businesses dealing with international customers.

- Fraud Prevention: Comes with PCI DSS Level 1 compliance and built-in fraud detection.

- Subscription Billing: Supports recurring payments, which is essential for membership-based eCommerce.

- Customizable Payment Pages: Offers the ability to customize the payment page to align with your brand.

Pricing and Fees

- Transaction Fee: 2.75% per transaction for domestic cards and 3.25% for international cards.

- No Setup Fees.

Pros

- Supports multiple currencies and secure transactions.

- Long-standing reputation in the Indian market.

Cons

- Slightly higher transaction fees.

9. Atom Paynetz: Perfect for Small Businesses

Atom is a robust payment gateway ideal for small and medium businesses. It’s also known for its IVR-based payment options, which allow customers to make payments over the phone.

Features and Benefits

- Wide Range of Payment Options: Supports UPI, cards, wallets, and net banking.

- IVR Payments: Accept payments through phone calls, making it unique in the market.

- Mobile Payment Integration: Supports mobile apps, which is excellent for mobile-first eCommerce sites.

- Fast Settlements: Provides quick settlements to your bank account, typically within 24-48 hours.

Pricing and Fees

- Transaction Fee: 2.1% for cards and net banking.

- No Setup Fees.

Pros

- Offers IVR-based payment solutions.

- Fast settlement process.

Cons

- Slightly limited to large enterprises.

10. MobiKwik Payment Gateway: Wallet and Payment Gateway Combo

MobiKwik, primarily known for its mobile wallet, also offers a payment gateway solution for eCommerce businesses. It’s a great option if your customers are frequent MobiKwik users.

Features and Benefits

- MobiKwik Wallet Integration: Directly integrates with the MobiKwik wallet, allowing quick payments for millions of users.

- UPI and Netbanking: Accept payments via UPI, credit/debit cards, and Netbanking.

- Instant Refunds: Offers a fast refund mechanism, which is great for improving customer trust.

- In-App Payments: These can be integrated into mobile apps for in-app purchases.

Pricing and Fees

- Transaction Fee: 1.8% for UPI and wallets, 2.5% for cards.

- No Setup Fees.

Pros

- Perfect for businesses targeting MobiKwik wallet users.

- Quick setup and easy integration.

Cons

- It is not as comprehensive for businesses that do not target MobiKwik users.

11. HDFC Payment Gateway: Reliable for Enterprises

HDFC offers one of the most reliable and secure payment gateways in India. It’s designed specifically for medium—to large eCommerce businesses and backed by the trusted HDFC Bank.

Features and Benefits

- Comprehensive Payment Methods: Supports all major cards, UPI, Netbanking, and wallets.

- High-Level Security: Comes with PCI DSS Level 1 certification, ensuring the highest level of payment security.

- Dedicated Support: Provides a dedicated support team for businesses with high transaction volumes.

- Customizable Solutions: Tailored solutions for businesses based on size and transaction needs.

Pricing and Fees

- Custom pricing based on transaction volume. Contact HDFC Bank for specific details.

Pros

- High security and support for high-volume businesses.

- Excellent for enterprises.

Cons

- It is best suited for larger businesses but not ideal for startups.

12. ICICI Payseal: Secure and Scalable

ICICI Bank’s Payseal is another strong option for large businesses. It offers a high degree of security and scalability for growing eCommerce platforms.

Features and Benefits

- WBroadPayment Support: Supports cards, UPI, and Netbanking.

- Customizable Solutions: Tailored for large enterprises with the need for secure and scalable payment systems.

- Dedicated Support: Offers 24/7 support for businesses with high transaction volumes.

- Fraud Detection: Provides built-in fraud detection tools, helping businesses avoid chargebacks.

Pricing and Fees

- Custom pricing based on transaction volume. Contact ICICI Bank for specific details.

Pros

- Strong security and excellent scalability.

- Great for high-volume businesses.

Cons

- It is not ideal for small or medium-sized businesses.

13. PayPal India: Best for International Payments

While PayPal is a global giant, it has a significant presence in India. It is one of the most popular payment gateways for ecommerce websites in India, and it has international clients.

Features and Benefits

- International Payments: Accept payments from customers across the globe in multiple currencies.

- Buyer Protection: Offers PayPal Buyer Protection, increasing customer trust.

- Simple Integration: Easy to integrate with most eCommerce platforms.

- Subscription Billing: Ideal for businesses with subscription-based models.

Pricing and Fees

- Transaction Fee: 4.4% per transaction for international payments, plus a fixed fee based on the currency.

- No Setup Fees.

Pros

- Great for international transactions.

- Trusted brand with buyer protection.

Cons

- High fees for international payments.

- They have limited local payment options like UPI.

14. Airtel Payments Bank Gateway: Seamless for Mobile Payments

Airtel’s Payments Bank Gateway offers a payment solution targeted at mobile-first businesses, which is ideal for companies that cater to a large mobile user base.

Features and Benefits

- Airtel Wallet Integration: Accept payments from Airtel wallet users, in addition to cards, UPI, and Netbanking.

- Fast Settlements: Enjoy same-day settlement of funds.

- No Maintenance Charges: No recurring fees to maintain the gateway.

Pricing and Fees

- Transaction Fee: 2% – 2.5%, depending on the payment method.

- No Setup Fees.

Pros

- It is ideal for businesses targeting mobile users.

- Fast settlement and zero maintenance fees.

Cons

- Limited features compared to more prominent gateways.

15. Cointab: Payment Gateway for UPI Lovers

Cointab is a UPI-based payment gateway solution designed for Indian businesses. It’s particularly effective for companies that rely heavily on UPI transactions.

Features and Benefits

- UPI Payments: Optimized for UPI payments, making it a seamless solution for mobile users.

- Bulk UPI Payments: Allows businesses to process bulk payments using UPI.

- Automated Reconciliation: Offers automatic reconciliation, reducing manual effort for businesses.

Pricing and Fees

- Custom pricing based on transaction volume. Contact Cointab for more information.

Pros

- Optimized for UPI-based payments.

- Great for businesses dealing with UPI-heavy customer bases.

Cons

- Limited support for other payment methods like cards and wallets.

Conclusion: Choosing the Right Indian Payment Gateway

For Indian eCommerce businesses, the choice of a payment gateway will depend on your specific needs—whether it’s the ability to handle international transactions or local payment methods like UPI and Netbanking. Here’s a quick recap:

- Razorpay: Best for a versatile and all-in-one payment solution.

- Paytm Payment Gateway: Ideal for businesses that want to tap into the Paytm wallet user base.

- CCAvenue: Great for companies that need comprehensive payment options and multi-currency support.

- Instamojo: Perfect for small businesses, freelancers, and those without a website.

- Cashfree: Best for businesses requiring bulk payouts and instant refunds.

- PayU: Widely used and reliable, with excellent security.

By carefully considering each gateway’s features, fees, and customer support, you can choose the one that best suits your business and customer base.

FAQs

1. What is UPI, and why is it important for Indian payment gateways?

UPI stands for Unified Payments Interface, a real-time payment system in India that allows instant money transfers between bank accounts via mobile phones. It’s widely used, making it a critical payment method for Indian customers.

2. Can I accept international payments with Indian payment gateways?

Yes, many Indian gateways, such as Razorpay, PayU, and CCAvenue, support international payments and multi-currency transactions, though additional fees may apply.

3. What is the best payment gateway for startups in India?

For startups, Razorpay and Instamojo are excellent choices due to their easy setup, versatile payment methods, and affordable pricing structures.

4. Are payment gateways in India secure?

Yes, the primary Indian payment gateway,e Razorpay, Paytm, and CCAvenu,e comply with PCI-DSS standards, ensuring secure transactions and data protection.

5. How long does it take to set up a payment gateway in India?

Most Indian payment gateways offer quick setups, with Paytm, Razorpay, and Instamojo allowing you to start processing payments within a day or two.